What is Homestead Exemption?

Homestead Exemption removes part of your home’s value from taxation, lowering your taxes. For instance, if your home is appraised at $100,000 and you qualify for a $20,000 exemption, you would pay taxes as if your home was only worth $80,000.

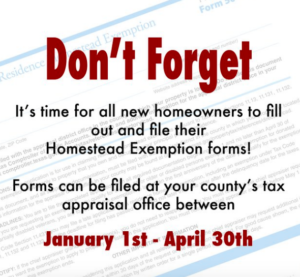

When to apply?

Regular Residential Homestead Exemption applications should be filed between January 1 and April 30.

Here are some helpful resources about how to apply for homestead exemption for those of you who live in the Greater Houston Area…

Filing Homestead Exemption in Brazoria County

Brazoria County Appraisal District Information

Brazoria County Homestead Exemption Information

Download the Brazoria County Homestead Exemption Form

Filing for Homestead Exemption in Chambers County

Chambers County Appraisal District Information

Chambers County Homestead Exemption Form Submission Information

Fill out the Chambers County Homestead Exemption Form

Filing Homestead Exemption in Fort Bend County

Fort Bend County Appraisal District Information

Fort Bend County Homestead Exemption Information

Download the Fort Bend County Homestead Exemption Form

Filing for Homestead Exemption in Galveston County

Galveston County Appraisal District Information

Download the Galveston County Homestead Exemption Form

Filing Homestead Exemption in Harris County

Harris County residents can now file Homestead Exemption through a mobile app for iPhone and Android:

Click here to learn more about the Harris County app.

Harris County Appraisal District Information

Harris County Property Tax Exemption for Homeowners Info

Download the Harris County Homestead Exemption Form

Filing for Homestead Exemption in Liberty County

Liberty County Appraisal District Information

Fill out the Liberty County Homestead Exemption Form

Filing Homestead Exemption in Montgomery County

Montgomery County Appraisal District Information

Montgomery County Homestead Exemption Information

Download the Montgomery County Homestead Exemption Form

Filing for Homestead Exemption in Waller County

Waller County Appraisal District Information

Property Tax Exemptions for Homeowners in Waller County

Download the Waller County Homestead Exemption Form

Other Resources:

Homestead Exemption FAQs (resource from the Texas Comptroller of Public Accounts)

Still have questions? We’d be happy to help! Email or call us today:

281-229-1832 Info@camodernrealty.com

0 Comments Leave a comment